I remember being swept up in the early Foursquare craze. I raced around my little town checking in at my local Starbucks and favorite lunch spots to become The Mayor. I worked hard to keep it by doing drive by check ins as I was stuck at traffic lights. I know, I’m hyper competitive on certain things. Friends and I would compete on who could win the most badges too! I quickly earned the “jet setter” badge with frequent flights from SJC to SNA. Other friends won the “crunked” badge with late night shenanigans. Ahh to be a DINK again. All for what? For pure competition and Facebook feed bragging rights!

I remember being swept up in the early Foursquare craze. I raced around my little town checking in at my local Starbucks and favorite lunch spots to become The Mayor. I worked hard to keep it by doing drive by check ins as I was stuck at traffic lights. I know, I’m hyper competitive on certain things. Friends and I would compete on who could win the most badges too! I quickly earned the “jet setter” badge with frequent flights from SJC to SNA. Other friends won the “crunked” badge with late night shenanigans. Ahh to be a DINK again. All for what? For pure competition and Facebook feed bragging rights!

At a deeper level, I hoped that eventually I’d receive relevant geographically based alerts and rewards on my phone as I walked by a restaurant or store. Unfortunately, many of these rewards required an AMEX card subscription (creating a HUGE hurdle) or were nothing more than a free drink at check in. Big whoop. Sigh…it was very clear that geo based local marketing had not made the jump from great concepts to effective execution. However, this is all changing quickly with the launch of mobile payment solutions like Apple Pay and well designed retail loyalty mobile apps. Real customer value can be delivered at the right time. Banks can also make HUGE strides in building more meaningful customer relationships beyond checking accounts. FINALLY!!!!!

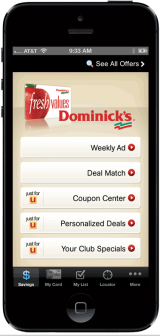

My family and I are loyal Safeway customers for the majority of our food. The loyalty was solidified by Safeway launching a program that contained several weekly coupons and special offers based on shopping activity. A key component of the loyalty program is the Safeway mobile app which serves as the main touch point for how offers are communicated to consumers. Just recently, Safeway has pushed daily offers that appear on the front scream of my mobile device. Last week I made a special trip into Safeway’s deli to take advantage of a sandwich offer that was delivered to my phone that morning. Cool. There are several other retail apps, Starbucks for example, that deliver this customer value in a similar way. All of these apps have a way to go on using geo fencing technology to send me offers as I’m nearby or actually in store. Clearly this will be coming!

I mentioned in a previous post that I recently completed my first Apple Pay transaction at Sports Authority. It took me 6 months to actually do this after I loaded all of my cards. Honestly, I forgot to use Apple Pay and struggled with finding locations that use it. I opine in my last post that Apple Pay must do a lot more to remind users that “Apple Pay is Accepted Here” to drive adoption. Steps are being taken to do so for I saw an Apple Pay logo appear on a Walmart payment terminal as I purchased Easter cards.

So where do banks fit in creating greater customer value? Apple Pay requires that customers enter in debit cards and credit cards to make payment. Banks provide these cards. Banks frequently offer rewards programs and provide an incentive to shop a designated retail location. By not actively engaging in this payments ecosystem, banks are LOSING OUT BIG TIME on engaging with customers in a meaningful way with relevant, geo targeted offers.

For example, let’s say a consumer is using a Wells Fargo bank card for Apple Pay. The consumer pays for items at Walmart that is a member of Well’s Earn More Mall program. The consumer is then informed that they receive double points and are reminded of other Earn More Mall retailers that may be geographically close by. How powerful is that for Wells to influence consumer purchase decision and drive usage of its cards?!

For example, let’s say a consumer is using a Wells Fargo bank card for Apple Pay. The consumer pays for items at Walmart that is a member of Well’s Earn More Mall program. The consumer is then informed that they receive double points and are reminded of other Earn More Mall retailers that may be geographically close by. How powerful is that for Wells to influence consumer purchase decision and drive usage of its cards?!

Unfortunately, this type of consumer influence will not be available to banks through Apple Pay. Apple has decided to not share consumer purchase data with card providers/banks. Clearly Apple is looking to own the consumer relationship AND control the valuable behavioral data. However, given the amount of marketing activity driven by banks, especially Wells Fargo, this seems a little one-sided of Apple…giving room for a competitive payment platform that helps consumers AND banks. Banks need to use their power to guide the creation of a payments ecosystem that builds deeper customer relationships.

As we all know, Android OS based Samsung announced the acquisition of LoopPay as their digital payments platform and competitive solution. It would not be surprising if the Android OS based Samsung phones enable banks to access purchasing data to banks and provide the channel to communicate special offers. For a fee, of course. Apple and Samsung need to be reminded of the power banks have in the transaction process. Banks provide the cards! Strangely, BANKS need to be reminded of the power THEY have in influencing the payment ecosystem. The larger banks like Bank of America and Wells Fargo, have enormous power. At the current moment, banks are willing to draft on the success of Apple Pay. Wells Fargo even promotes their Apple Pay features in TV commercials. Cleary banks see value in positioning themselves as “cutting edge.” However, this affiliation is purely brand driven and not consumer value drive. If a bank can be promised greater access to consumer data AND direct access to consumers through the device, banks will drive great consumer value while promoting new technology. Because of the consumer value focus, banks will promote one payments solution over another…and mean it.

I started off my week with a trail run and then a quick stop off at a downtown locally owned coffee joint. The coffee shop is filled with laptop toting Silicon Valley types, local Lululemon wearing trail bunnies and a myriad of salon and spa employees on their way to bill $150 for a 1-hour deep tissue massage. I stood in line and waited to pay for my overpriced cup of coffee. I’m an old school guy and paid in cash while most people paid using their debit/credit card. It seems strange to me to pay for something so cheap with plastic…but, hey, I AM old school right? However, of the 10+ payment transactions I saw, no one paid with his or her phone using the NFC feature of the payment reader. Now don’t panic…you are not the only one who has not seen the NFC technology in action. Very few merchants even have a card reader that includes NFC technology.

I started off my week with a trail run and then a quick stop off at a downtown locally owned coffee joint. The coffee shop is filled with laptop toting Silicon Valley types, local Lululemon wearing trail bunnies and a myriad of salon and spa employees on their way to bill $150 for a 1-hour deep tissue massage. I stood in line and waited to pay for my overpriced cup of coffee. I’m an old school guy and paid in cash while most people paid using their debit/credit card. It seems strange to me to pay for something so cheap with plastic…but, hey, I AM old school right? However, of the 10+ payment transactions I saw, no one paid with his or her phone using the NFC feature of the payment reader. Now don’t panic…you are not the only one who has not seen the NFC technology in action. Very few merchants even have a card reader that includes NFC technology.

Apple announced a few months back a strategic alliance with Big Blue. I provided my point of view in an

Apple announced a few months back a strategic alliance with Big Blue. I provided my point of view in an