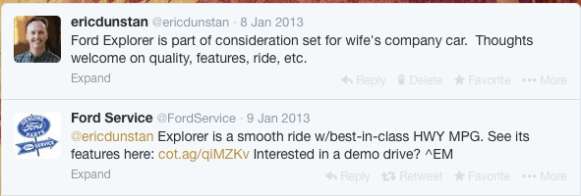

Last year my wife and I began our search process to find a new SUV. Our consideration set included Toyota, Ford and Chevrolet. I tweeted out one evening that we were considering the Ford Explorer and asked for feedback from my community. Within 24 hours I received a reply…not only from friends, but also from Ford. The response included a link to the Explorer’s features and an offer to schedule a test drive. Color me impressed. (Tweet me at @ericdunstan with the 80s movie reference)

I responded that we were interested in a test drive. A Ford rep quickly responded and offered to schedule a demo and to provide incentives.

Ford is effectively using social media as a lead generation tool and quickly acquired my information to schedule a test drive. I used all natural language text with no # or handles. Clearly Ford is monitoring the social media channels and has an effective strategy to capture the information and act on it. Nice work.

I recently blogged about my frustration with the mobile deposit feature of the Wells Fargo mobile application. I tweeted my frustration as part of a theraputic venting processes. Within 24 hours Wells Fargo replied with a tip to address the mobile application #fail and a request for me to call a 1-800 number to address any further issues.

I applaud Well Fargo for capturing or “hearing” my frustration on Twitter and responding. However, given the importance of social media as a marketing channel, Wells Fargo’s response is almost a given. I would imagine that almost all of the Top 100 banks have similar processes in place to monitor and manage the social media channel. However, I believe Wells Fargo’s response falls short of meeting my customer needs and their social media team could learn a lot from what Ford is doing.

The Wells response was very generic and made me do the heavy lifting. “Try closing the app and restarting your phone. If the problem persists, please call 800….” Duh. Wells Fargo, I’ve been an iPhone user sense the iPhone 3 and know that restarting an app is a quick fix. However, given the Wells app recent reviews, I think this functionality fail is an application problem. Additionally, the LAST thing I want to do is call your 800 number to then have to dial through a myriad of prompts to eventually talk with a representative after a several minute wait.

The Ford response was very personal, responded to my specific question, and provided a channel to connect with a representative directly. Ford made me feel personally taken care of, listened to and treated as a desired customer. Wells could have worked harder by…

1. Offering to collect my information so an online/mobile customer service rep could contact me directly

2. Having the rep present the option of contacting him or her directly through a Twitter DM to help trouble shoot

3. Providing me a link to their website with a list of known issues

4. Acknowledging my frustration and offering an incentive as a “mea culpa” for their failed application

I feel like my concerns were heard by Wells Fargo, but I don’t feel personally taken care of to ensure my issue was resolved and that I’m a valued customer. This is an example of the difference between just listening to the customer and engaging with the customer. By engaging with the customer, Wells has the opportunity to personally respond to my need to show that my customer relationship is valued. Ford did this so well that we bought an Explorer from them.

Moving beyond just listening to and engaging with the customer may require rethinking how customer support teams are trained and incentivized. Additionally, companies should consider implementing a social media analytics and engagement software solution. These solutions go beyond functionality of Tweet Deck that enable users to track multiple accounts and listen for mentions of their company or brand. The more robust solutions, like Attensity or Nimble, for example, enable companies to listen to the customer, analyze the need and then act on meeting the customer need.

Consumers are increasingly frustrated with their banking relationship. There are a few Internet and mobile only banks, like GoBank or Moven, which take the mobile experience and customer service seriously. Leading banks, including Wells Fargo, will quickly lose customers should they not learn how to actively engaged with their customers through all channels of customer support, including social media.